test

2 End hunger, achieve food security and improved nutrition and promote sustainable agriculture

goal 3

goal 4

goal 5

goal 6

goal 7

goal 8

goal 9

goal 10

goal 11

goal 12

goal 13

goal 14

goal 15

Goal 16

16.3: Promote the rules of law and the national and international levels and ensure equal access to justice for all.

16.5: Substantially reduce corruption and bribery in all their forms

16.7 Ensure responsive, inclusive, participatory and representative decision-making at all levels

16.b: Promote and enforce non-discriminatory laws and policies for sustainable development

Goal 17

Risk Management & Compliance

Risk Management and Compliance Strategy

In 2024, the world slowly began to emerge from the grips of the COVID-19 pandemic, and business activity had resumed but it had not yet reached pre-pandemic levels. The situation had been further complicated by the Russian-Ukrainian War, China's lockdowns, rising inflation, increasing energy prices, and exchange rate fluctuations, all of which had the potential to affect business operations directly and indirectly. Furthermore, natural disasters resulting from the effects of global warming posed an additional threat to the sustainability of business operations. Moreover, as awareness of climate change grew, consumers were increasingly demanding sustainable products and services. This had led to the rise of eco-friendly products and services, requiring businesses to adapt their product and service offerings and marketing strategies.

BJC realized that it was crucial that the company carefully consider these external factors and their potential impacts when crafting sustainable business strategies. The company recognized the urgent need for corporate risk and crisis management in today's ever-changing and unpredictable global landscape by going above and beyond to mitigate the risks and challenges associated with these issues. BJC's proactive approach to risk management in 2024 involved identifying potential risks and implementing measures to address them before they become crises. For instance, the company had taken significant steps to reduce its carbon footprint and promote sustainable practices across its diverse portfolio of businesses. By investing in various initiatives, BJC was not only mitigating the risks associated with climate change, but also going beyond that by demonstrating its commitment to environmental sustainability and social responsibility.

Risk Management and Compliance Management Approach

BJC has prioritized risk and crisis management as an integral part of its business strategy. By conducting risk assessments and developing comprehensive crisis response plans, BJC is prepared to respond quickly and effectively to unexpected events, such as natural disasters or political instability. Through its commitment to risk and crisis management, BJC is demonstrating its dedication to ensuring the long-term success and sustainability of its business, while also contributing to a more resilient and sustainable economy. At BJC, corporate risk management is held in high regard. To ensure effective Corporate Risk Governance, the Risk Management Committee authorized by the Board of Directors, oversees the risk management process, while senior management keeps a watchful eye on the risk management of each business unit. Moreover, to further ensure the effectiveness of enterprise risk management of the organization and aligned with the international standards such as ISO 31000, the company conducts an internal audit of the risk management process by Group Internal Audit Department's experienced personnel with a full understanding of BJC's nature of business and supporting functions. As well as an independent third-party audit covering the two fiscal years 2023 and 2024, with no non-compliance issue. The Risk Management Committee also formulates and reviews corporate-wide risk management policy, goals and frameworks to be appropriate for the company's business operations in accordance with the national and international standards. Furthermore, BJC's corporate risk management strategy goes beyond simply assessing risks. In fact, the company also actively seeks out new business opportunities that arise from potential risks. This approach not only ensures the preservation of company value but also creates additional value for both BJC and its stakeholders.

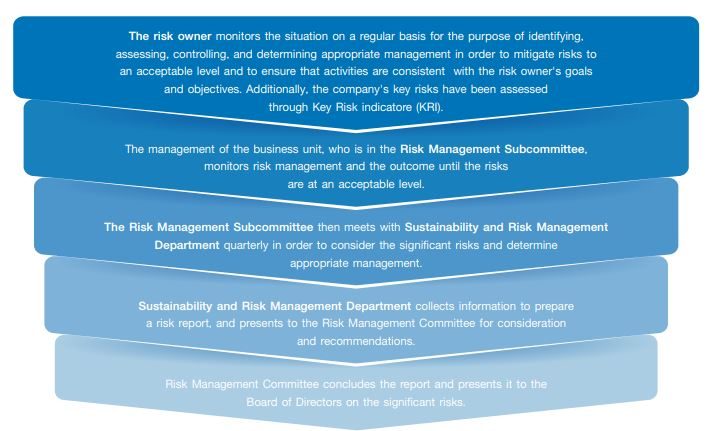

Risk Governance

The Risk Management Committee (RMC) is structural independence from the business units to supervise enterprise risk management, including define the methods and processes used by organizations to manage risks and seize opportunities related to the achievement of company objectives. Risk Management Subcommittee (RMS) reviews, creates, identifies and assesses BJC’s corporate and business unit level risks. The subcommittee will assess, consolidate and report corporate and ESG's risk assessment and risk exposure on a regular basis to the Risk Management Committee and BJC’s Board of Directors on a quarterly and annual basis respectively. Audit committee is responsible for evaluate the efficiency of BJC’s risk management to ensure the relevance and effectiveness.

Moreover, BJC's non-executive members of the board of directors consist of experts with diversed experiences and backgrounds. There are 2 non-executive members of the board of directors with expertise in risk management: 1) Mr. Tevin Vongvanich, who has experiences in risk management from Amata Corporation Public Company Limiteda and Indorama Ventures Public Company Limited 2) Ms. Potjanee Thanavaranit, who had a training on Risk Management Program for Corporate Leaders from Thai Institute Of Directors (IOD).

Additionally, Sustainability and Risk Management Division (SRM) support risk communication to build a risk culture by educating employees at all levels on the importance of risk management, including the development of a common language, creating the understanding and supporting management decisions. SRM promotes the effectiveness of project-level and enterprise-wide risk management with the focus on raising risk awareness for the management and staff to have proper and appropriate utilization of resources and involvement in actions.

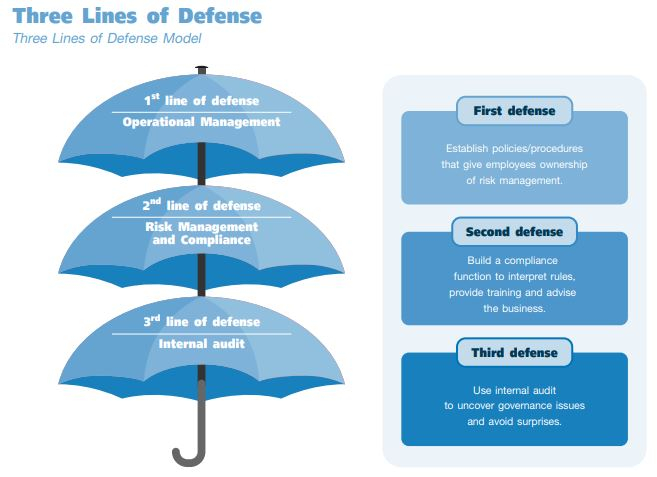

BJC strictly complies with the principles of supervision and risk management outlined in The Three Lines Model (2020) of Institute Auditors: IIA, cascaded into the 'Three Lines of Defense’ process to oversee risk management, separating structures, roles, duties, responsibilities, and decision-making authority, ensuring process transparency through BJC’s Board of Directors, Risk Management Committee (RMC), Risk Management Subcommittee (RMS), Audit Committee and Sustainability and Risk Management Division (SRM).

Highest ranking person with dedicated risk management responsibility on an operational level: Ms. Anchalee Rimviriyasab, Chief Financial Officer and Chief Transformation & Sustainability Officer.

Reporting line: Sustainability and Risk Management Division (SRM) reports to Risk Management Committee (RMC) concerning overall risk management in the organization. This includes risk analysis of impacts to the company if such risks were to occur, in order to ensure the effectiveness of BJC’s risk management plan. Risk Management Committee’s meeting is held quarterly (4 times per annum). The Chairman of RMC reports to the Board of Directors on the company's overall risk management performance on a quarterly basis. Meanwhile, SRM also reports to the CEO and President to ensure that the risk management execution plan is aligned with business strategy, on schedule, as well as effective in managing risk within risk appetite.

Highest ranking person with responsibility for monitoring and auditing risk management performance on an operational level: Mrs. Orawan Supamathaporn, Executive Vice President of Group Internal Audit.

Reporting line: Group Internal Audit Division (GAD) directly reports to Audit Committee (AC) to consult and assess whether operational and compliance control policies and strategies in status quo cover existing and emerging risks to the company. The reporting line enables independent assessment without potential conflict of interests coming from other departments. Audit Committee’s meeting is held at least quarterly (4 times per annum) with the addition meetings between internal auditors to expression of independent opinions without Management’s influence. The chairman of AC reports to the Board of Directors on the company's overall control and relevant issues on a quarterly basis. Meanwhile, GAD also reports the implementation of projects or activities contributing to risk management, monitoring and auditing to CEO and President, to ensure effective internal control cover financial, operational and compliance control.

Three Line of Defense

Berli Jucker public Company Limited and the group company (BJC Group) implemented the "Three Lines of Defense" principle, a well-regarded methodology in risk management and governance, to safeguard its operations and ensure long-term success.

1st Line Defense

The operational management and employees of BJC served as the primary line of defense. These committed experts served as the company's primary defense, overseeing daily activities and immediately handling any potential risks. They proactively established internal controls and processes to effectively address any potential concerns. Each and every employee, regardless of their position, made a substantial contribution to the company's transparency and efficiency.

2nd Line Defense

The Risk Management Division represented the Second Line of Defense. This team of experts was responsible for supervising and directing the initial operations, ensuring that the existing controls and procedures were not only sufficient but also efficient. BJC provided essential frameworks, methodology, tools and training to operational managers and employees, enabling them to gain a comprehensive understanding of potential risks and effectively control them. The Risk Management Division oversaw adherence to regulations and evaluated potential risks, responding to improve procedures and address any emerging issues before they could worsen.

3rd Line Defense

The Group Internal Audit served as the Third Line of Defense in BJC's defense system. This team of proficient auditors delivered independent and objective assurance, assessing the efficiency of both the primary and secondary lines of defense (Risk management and compliance processes). They carried out comprehensive audits, examining each aspect of BJC's operations and governance. The Group Internal Audit provided direct reports to Audit Committee and indirect reports to CEO and President and the Management Board, delivering insights and recommendations to improve the overall control environment. Their evaluations and finding with recommendations were essential for upholding transparency and accountability within the company.

By incorporating these three levels of safeguarding and Berli Jucker Public Company Limited strengthened its resilience against potential risks and uncertainties. The collaboration between the operational management, the Risk Management Division, and the Group Internal Audit established a strong structure that safeguarded the company and facilitated its sustainable expansion and success. By adopting a complete approach, BJC was able to maintain its resilience and agility, enabling it to effectively address issues and capitalize on opportunities in a constantly changing business environment.

Risk Assessment and Management Process

BJC has a continuous risk management with the following Risk Assessment and Management Process;

BJC has established policies and risk management process in order to assess, consolidate and report cooperate and ESG risk assessment on quarterly basis and annual basis respectively. In 2024, processes across BJC’s business group have 100% of risk assessment in all business unit, and 100% of all business unit have mitigation plan. The assessment has been implemented throughout BJC to constantly monitor risk management processes. Throughout the procedure, the key cooperate risk (KRI) is developed to serve as a predicator for precaution and monitoring of risk management efficiency.

Furthermore, BJC uses RM online system to collect data and prepare risk reports of business units to achieve more efficient risk management. As for the risk assessment, the risks are categorized as follows;

The RM online system enables the business units to access risk management real-time, anytime and anywhere. The system also saves time for BUs by providing risk evaluation tools, which are relevant to the objectives of each BU. This allows the Risk Impact to be more accurately calculated and the risk impact can better reflect the current situation of different business operations. Finally, the root causes of the risks are determined as well as the impact of the risks, which includes financial impact and non-financial impact. The Risk Level is then determined by assessing the impact and likelihood of the risks. The company assess the risk level before inherent risk, and then identify the existing management and management that needs to be done so that the level of residual risk is acceptable. For the risk management that needs to be done, responsible persons are assigned and the due date is also set.

Risk Management 2024

BJC realizes the need of continuous learning and adaptation in order to navigate economic changes and unforeseen situations. Additionally, they emphasized the value of contributing to and being responsible for the environment and society. As a consequence, BJC has established a business operation strategy, including proactive and passive measures, to ensure that the business runs effectively and efficiently. BJC assesses potential positive (Opportunity) and negative (Risk) factors impacting business operations for the benefit of all stakeholders and the long-term sustainability of the company.

As for Emerging Risk, BJC monitors news and information then the company considers related risks continuously to formulate prompt and appropriate mitigation actions. After the analysis, the significant emerging risks at present which may affect BJC's business are updated and described below.

Emerging Risk

1. Regulatory Risk: Thailand’s Extended Producer Responsibility (EPR) Regulation and Other Waste mamagement Regulations

The Thai government is in the process of implementing a national EPR framework, which will require producers to assume full financial and operational responsibility for post-consumer packaging waste. This regulation is expected to be fully enforced by 2027. It will have direct implications for BJC’s Consumer Business (particularly snack products packaged in aluminum foil and personal care products packaged in plastic) as well as its Packaging Business, including glass and aluminum packaging.

In addition, the Bangkok Metropolitan Administration (BMA) has announced a new waste collection fee regulation which will be enforced in October 2025. This regulation elevates previous voluntary measures into an integrated approach combining economic and legal instruments. The new fee structure represents a threefold increase from the previous rate, aiming to encourage the public and communities to recognize the importance of waste separation and to actively participate in improving environmental quality. It also introduces a fairer system in which households or businesses that separate waste will pay lower fees than those that do not.

The implementation of this regulation by the BMA could serve as a role model for other provinces in Thailand, potentially leading to nationwide adoption. As a result, businesses will need to adapt their waste management practices to reduce the volume of waste sent for disposal, thereby minimizing the impact of higher waste collection fees which could otherwise significantly increase operating costs

Business Impact

-

Increased operational complexity due to legal obligations for waste management, recovery, and recycling.

-

Increased pressure to transition toward sustainable and recyclable packaging materials.

-

Potential brand and reputational exposure in the event of non-compliance.

-

Estimated packaging cost increase: 8–12% without proactive material substitution and design optimization.

Mitigation Plan

-

Redesign personal care products under brands such as Parrot by adopting recyclable PET bottles or PCR-based plastics to enhance recyclability and reduce potential future fee burdens.

-

Consider to invest in packaging R&D for snack products such as Tasto, Party, Campus to transition from multilayer foil to recyclable mono-material pouches (e.g., mono-PP film) while ensuring product quality and hygiene are maintained.

-

Packaging Data Management: Implement a centralized packaging data management system—such as an SAP-based module—across manufacturing and retail operations to monitor material types, weights, and end-of-life recovery status. This will support regulatory reporting and cost forecasting tied to EPR compliance.

-

Waste Management Procedure: Revise internal waste management procedures and ensure strict communication, training, and compliance monitoring to maximize waste separation at the source. This will help minimize waste sent for disposal and reduce waste management fees charged by local authorities in operational areas.

-

Participate in Thailand’s PRO initiatives, such as the PackBack scheme, to manage post-consumer packaging waste through a holistic, end-to-end approach. This includes engaging stakeholders across the value chain—consumers, retailers, waste collectors through to recyclers, as well as working with local authorities to develop systematic infrastructure for waste collection and management. In addition, collaborate on planning, policy adjustments, and local regulations to maximize collection efficiency.

-

Supplier Collaboration: Collaborate with packaging suppliers to ensure that glass bottles and aluminum cans meet upcoming recyclability and traceability requirements. Set minimum recycled content targets and require suppliers to provide traceability certifications. Furthermore, work closely with Grungthai Group, a subsidiary of BJC BigC specializing in integrated waste management services—including collection and procurement of recyclable materials such as glass cullet, plastics, paper, and aluminum—to strengthen recycling capabilities and ensure effective compliance with Thailand’s forthcoming EPR framework.

-

Sustainability Communication: Develop and launch a communications strategy to showcase BJC’s transition to sustainable packaging. Leverage in-store labeling, social media campaigns, and corporate communication channels to reinforce brand credibility and emphasize BJC BigC’s strong commitment to sustainability.

-

Financial Planning: Integrate anticipated EPR fees into multi-year financial planning, particularly for high-volume product categories. Packaging fee estimates should be incorporated into product cost structures and pricing models to safeguard margins and guide long-term category strategies.

2. Geo-economic Risks

In today’s global environment, geo-economic risks are intensifying and presenting complex operational challenges for BJC across its retail, packaging, and consumer product businesses. Geopolitical tensions between China and the United States have escalated, with China consolidating leadership among the Global South while the U.S., together with Russia, seeks to expand influence across Southeast Asia. This emerging “dual-sphere” global system is reshaping trade flows, investment priorities, and supply chain dynamics, thereby amplifying uncertainty.

Beyond geopolitics, international economic competition, shifts in global trade policies, persistent currency volatility, and instability in energy and natural resources markets are further undermining business confidence. These dynamics are no longer abstract risks; they are translating into immediate economic consequences. B2B customers are deferring investment decisions to await clearer signals on market direction, while general consumers—both domestic buyers and international tourists—are exercising caution and reducing discretionary spending. For BJC, this convergence of factors threatens revenue stability and heightens operational costs, especially in relation to supply chain disruptions and foreign exchange exposure.

Business Impact

-

Investment Delays: B2B customers are holding back on new contracts and capital commitments as they monitor global economic and geopolitical shifts.

-

Consumer Spending Contraction: Domestic consumers and inbound tourists are reducing discretionary expenditures, directly impacting retail and consumer product sales.

-

Revenue Pressure: Combined effects may result in reduced top-line growth across retail, packaging, and consumer product segments.

-

Rising Operating Costs: Currency fluctuations, raw material price volatility, and logistics disruptions are increasing the cost base and eroding margins.

Mitigation Plan

To safeguard performance and enhance resilience, BJC will adopt a multi-pronged strategy:

1. Consumer-Centric Offerings

-

Private Label Development: Strengthen private label and house brand portfolios with quality, affordable products supported by effective promotions to reinforce value perception and support consumer spending.

- Profitability Focus and Pricing Strategy: Increase the proportion of high-margin categories to maintain overall profitability while review and adjust pricing structures to ensure competitiveness and market relevance.

- Customer Experience: Enhance the shopping experience through improvements to product displays, and customer service touchpoints, entrances, restrooms, etc.

2. B2B Relationship Management

- Strengthen partnerships by offering flexible agreements and customized support.

- Emphasize cost efficiency and long-term value creation to support customers during periods of uncertainty.

3. Market and Product Diversification

- Packaging Expansion: Pursue new geographic markets and customer segments.

- Glass: Expand into India, Sri Lanka, and Laos, including the premium bottle segment.

- Cans: Enter new beverage categories such as vitamins, dairy, coffee, and functional drinks.

- Glass Packaging Efficiency: Closely monitor customer demand and provide cost-reduction solutions, such as optimized bottle design, to improve competitiveness.

4. Supply Chain and Resource Resilience

- Diversify sourcing of raw materials across multiple geographies.

- Optimize inventory management to enhance flexibility.

- Invest in domestic recycling and circular economy initiatives for metals, glass, and pulp to mitigate external shocks and strengthen sustainability credentials.

5. Financial Hedging and Cost Controls

- Actively monitor raw material markets to recalibrate procurement and pricing strategies.

- Utilize forward exchange contracts and other financial instruments to reduce exposure to currency fluctuations.

Compliance Risk

The introduction of a carbon tax in Thailand presents a significant challenge for many businesses, particularly those in heavy industry and the retail sector, where operations heavily depend on electricity. This tax, designed to reduce carbon emissions, imposes a cost on the carbon content of fossil fuels and other carbon-emitting activities. At Berli Jucker Public Company Limited (BJC), we recognize both the challenges and opportunities this regulatory change brings. To prepare for its impact, we have conducted a thorough analysis of both the positive and negative consequences. Here, we outline the key risks associated with the carbon tax and our strategic actions to manage them.

Risk from New Laws Related to Climate Change

Risk posed by recent legislation associated with climate change after the 26th Conference of the Parties (COP26) organized by the United Nations Framework Convention on Climate Change (UNFCCC), global awareness on the significance of addressing global warming and climate change has increased, especially in Thailand. As a result, various government agencies and relevant entities are contemplating the implementation of legislation and regulations pertaining to climate change, such as the Climate Change Act (also known as the Global Warming Act) and Carbon Tax. These measures are expected to be imposed within the next 1-2 years. Government agencies are prioritizing various environmental measures in addition to the previously enforced Extended Producer Responsibility (EPR) statute, which specifically applies to packaging. These policies encompass the reduction of plastic usage, particularly single-use plastics, and the enforcement of more rigorous waste separation guidelines, which are anticipated to be more strictly enforced in the near future. Successfully navigating the current regulatory environment can be difficult due to the potential for non-compliance with carbon tax legislation, which could result in financial penalties and harm to one's reputation.

Business Impact

The introduction of new laws and regulations related to climate change, such as the Climate Change Act, Carbon Tax, and Extended Producer Responsibility (EPR) law, poses significant challenges for businesses. Compliance with these regulations may require changes and improvements in current operational processes, such as implementing waste separation measures and reducing plastic usage. These adjustments could lead to increased operational costs, including legal expenses associated with the carbon tax. Additionally, adapting to new regulations demands substantial resources, including manpower, time, and investments. Failure to comply fully and accurately with these regulations could result in financial penalties and reputational damage. Furthermore, the need for continuous monitoring and adaptation to regulatory changes can strain business resources, impacting overall efficiency and profitability.

Mitigation Plan

In order to manage these risks associated to upcoming climate change policies, BJC implement the following mitigation strategies:

- Implement Active Monitoring and Engagement by the specialized group who have experience that will consistently monitor and track regulatory changes concerning climate change.

- Cultivate robust partnerships with government agencies and relevant groups, such as the Greenhouse Gas Management Organization (TGO) and the Federation of Thai Industries. Engage actively in industry associations and projects such as the Carbon Neutral Network of Thailand to be well-informed about forthcoming legislation and to have a venue for offering input and suggestions.

- Implement a centralized data gathering system to precisely monitor greenhouse gas emissions and other environmental impacts. To uphold conformity with international standards and strengthen the reliability of publicly published information and having third-party verification to validate the accuracy of the data.

- Establish and execute all-encompassing strategies to reduce the release of greenhouse gas emissions such as the installation of solar rooftops that promote the use of renewable energy, the implementation of projects aimed at reducing consumption of electricity, and the transition of transportation vehicles to electric vehicles (EVs). These measures are aimed to reduce the negative effects of carbon prices and other regulations.

- Regularly conduct training sessions for employees to enhance their understanding of new law and regulations and emphasize the significance of adhering to them.

Develop a close working relationship with suppliers to ensure their comprehensive understanding and adherence to newly implemented environmental law and regulations. Promote the adoption of sustainable practices among suppliers that are in line with the company's objectives, and give priority to forming partnerships with suppliers who are committed to lowering their environmental footprint.

Raising Risk Awareness and Education

The Risk Management Division conducts annual Enterprise Risk Management training across the organization, covering Enterprise Risk Management principles, frameworks, and processes. This initiative aims to strengthen an effective risk culture in line with COSO requirements, with targeted sessions emphasizing risk management principles throughout the organization.

The Enterprise Risk Management Framework (ERM) offers instruction on assessing, minimizing, and monitoring relevant risks for each business division, as well as establishing a system for monitoring both new and existing business units (upon request). A risk management workshop was organized at the organizational level, involving responsible people from each business unit/factory. The purpose was to enhance their understanding of risk management and raise awareness among all employees. The objective was to foster an in-depth knowledge of proper risk management practices among all employees. BJC has developed a Standard Operating Procedure (SOP) for Enterprise Risk Management in the Risk Management Online System (Company Intranet). This SOP helps with risk assessment processes while rendering data collecting more efficient in the upgraded system.

The Risk Management team conducted training sessions for employees in the manufacturing sector and other relevant personnel. Additionally, the Enterprise Risk Management training was expanded to include potential suppliers. The training covered the following topics;

- Importance and framework of Enterprise Risk Management

- Enterprise Risk Management process and methodology

- Risks trends (Covering Business risk, Environmental Social and Governance risk and emerging risk)

On a yearly the Risk Management Division presents a Top Risk Summary to both the Risk Management Committee (RMC) and the Sustainable Development Committee (SDC). The Top Risk Summary encompasses global risks, significant risks, and emerging risks that BJC firms currently encounter, along with a Risk Prevention and Mitigation Plan and the most up-to-date risk management strategies. The information was gathered and collected from reliable sources such as publications, research papers, and other credible references. Therefore, the report will be escalated to the executives of each Business Unit for review of the adequateness, appropriateness, and efficiency of their risk management plans and control measures in managing risks to risk appetite (acceptable level) and in accordance with established risk management principles. The purpose of this is to allow RMC and SDC to ensure that BJC's risk management is both effective and efficient, as well as suitable for the present scenario

To cultivate an effective risk culture, BJC has integrated risk management processes, procedures, and employee awareness throughout its operations. This integration involves regular education on risk management for non-executive directors and focused training throughout the organization on risk management principles and Enterprise Risk Management processes, provided both at the corporate level and as required by individual business units.

Additionally, in its New Product Development (NPD), BJC meticulously considers various risk factors, including financial, regulatory, and operational risks, among others. Furthermore, BJC strategically links significant risk and opportunity-related issues to employee incentives, ensuring a cohesive and proactive approach to risk management across the organization.

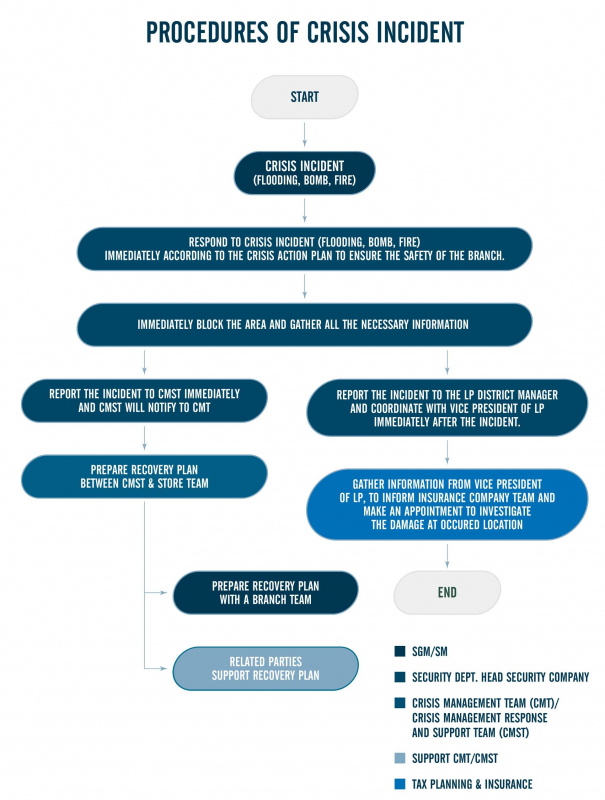

Crisis Management

The Crisis Management Team (CMST) consists of representatives from many departments, including the Crisis Management Leader, Communications, Operations, Human Resources, Legal, IT, Finance, Supply Chain, and so on. The CMST is usually a senior executive who oversees the entire crisis management process and coordinates amongst departments.

Crisis Management Structure

The CMST role and responsibility include identifying and evaluating potential threats and emerging crises, developing and implementing a comprehensive crisis management strategy, and conducting frequent drills to ensure readiness. They will coordinate response operations across departments, provide clear and timely information to stakeholders, and efficiently manage resources during a crisis. They are also in charge of establishing and implementing business continuity strategies, maintaining legal and regulatory compliance, and dealing with any legal issues that arise. Following a crisis, they perform a thorough analysis of the response, identify lessons learned, and revise the crisis management plan to better prepare for future responses.

|

1. Flood, Windstorm and Natural Disaster Recovery & Preventive Actions:

|

|

|

2. Insurgency in the South of Thailand (3 southern border provinces) Recovery & Preventive Actions:

|

|

|

3. COVID-19 Recovery & Preventive Actions:

|

|

|

Other Crisis Preventive Actions

|