test

2 End hunger, achieve food security and improved nutrition and promote sustainable agriculture

goal 3

goal 4

goal 5

goal 6

goal 7

goal 8

goal 9

goal 10

goal 11

goal 12

goal 13

goal 14

goal 15

Goal 16

16.3: Promote the rules of law and the national and international levels and ensure equal access to justice for all.

16.5: Substantially reduce corruption and bribery in all their forms

16.7 Ensure responsive, inclusive, participatory and representative decision-making at all levels

16.b: Promote and enforce non-discriminatory laws and policies for sustainable development

Goal 17

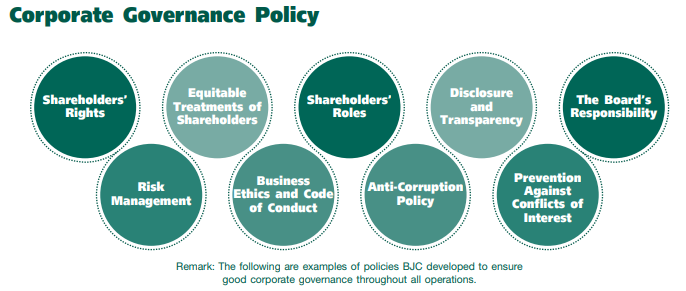

Corporate Governance

Mr. Charoen Sirivadhanabhakdi, Chairman Emeritus

Prof. Pirom Kamolratanakul, M.D., M.SC., Chairman of the Board of Directors

Board of Directors Commitment

Berli Jucker Public Company Limited (BJC) has proudly nurtured sustainable growth alongside Thai society, meeting the evolving needs of consumers while fostering shared prosperity. This enduring success is anchored in the dedication and expertise of the Board of Directors (BOD), a diverse group of leaders with in-depth industry knowledge, skills and experience. The BOD remains dedicated to fostering a corporate environment rooted in strong governance, ethical business conduct, transparency and sustainable development. To uphold this commitment, the company has established a comprehensive framework of policies and commitments designed to address material topics and align corporate objectives with long-term sustainability goals.

The Board plays a pivotal role in embedding environmental, social and governance (ESG) principles into corporate policies, decision-making and overall operations. By fostering a culture of accountability and aligning employees with the company’s core values under the ‘WINNING’ framework, BJC enhances its capacity to navigate emerging risks and capitalize on opportunities. This commitment ensures the company meets evolving stakeholder expectations for sustainability, reinforcing BJC’s reputation as a responsible and trusted partner in driving a more sustainable future.

The BOD’s proactive approach includes the development, implementation and regular review of strategies, policies and goals that align with societal changes and global sustainability priorities. To track the effectiveness of these actions, the BOD utilizes a combination of key performance indicators (KPIs), regular sustainability audits, stakeholder feedback and annual progress reports. These processes ensure continuous improvement and allow for adjustments as needed, ensuring that the organization remains responsive to evolving challenges and opportunities. Policies are made accessible in relevant languages — Thai, English and Vietnamese — to promote inclusivity and comprehension across all regions of operation. Moreover, all personnel under BJC’s governance, including full-time employees, contractors and service staff, are held accountable for upholding these high standards.

BJC also extends its commitment to sustainability by engaging with suppliers and business partners, encouraging them to align with the company’s values and adopt responsible practices. Through these collaborative efforts, BJC nurtures a culture of integrity, mitigates risks such as corruption and fraud and ensures transparent reporting mechanisms. Additionally, BJC takes proactive steps to manage both actual and potential positive impacts by investing in community development programs, supporting environmental initiatives and fostering innovation in sustainable products and services. Engagement with stakeholders has been integral to informing the actions taken, as BJC conducts regular consultations, surveys and focus groups with key stakeholders to better understand their needs and concerns. This feedback has been instrumental in shaping BJC’s sustainability strategies, helping the company focus on the most material issues. Regarding the effectiveness of these actions, BJC continuously tracks progress through key performance indicators (KPIs) and regular impact assessments. Moreover, BJC not only engages with stakeholders but also demonstrates how feedback is collected through detailed reporting mechanisms, including annual sustainability surveys, community outreach programs and direct dialogues with key partners. This feedback loop has allowed BJC to refine its corporate governance (CG) practices, ensuring that stakeholder input has directly contributed to enhancing the company’s sustainability initiatives and improving the effectiveness of its actions in managing social and environmental impacts. This holistic approach enhances corporate credibility and stakeholder trust, solidifying BJC’s reputation as a leading, sustainable retail organization dedicated to the well-being of all.

Board of Directors Structure

Berli Jucker Public Company Limited: Management Structure

The Board of Directors consists of 13 members (as of 15th August 2025), consisting of 9 independents, 2 executives, and 2 other non-executives. Each member is accountable for a distinct operation, allocated in accordance with their respective specific knowledge, expertise, and qualifications for the position in compliance with the Global Industry Classification Standard (GICS).

|

Board of Directors |

Date of Appointment |

|

1. Prof. Pirom Kamolratanakul, M.D., M.Sc. |

11 May 2016 |

|

2. Mr. Thapana Sirivadhanabhakdi |

22 Apr 2025 |

|

3. Mr. Tevin Vongvanich |

12 Nov 2019 |

|

4. Ms. Potjanee Thanavaranit |

14 Nov 2017 |

|

5. Mr. Thirasakdi Nathikanchanalab |

1 Aug 2002 |

|

6. Mr. Prasert Maekwatana |

1 Jan 2008 |

|

7. Police General Krisna Polananta |

23 Feb 2012 |

|

8. Mr. Rungson Sriworasart |

11 Nov 2015 |

|

9. Associate Prof. Kamjorn Tatiyakavee, M.D. |

15 Feb 2017 |

|

10. Associate Professor Pimpana Srisawadi, DBA |

22 Apr 2021 |

|

11. Mr. Prapakon Thongtheppairot |

13 Aug 2025 |

|

12. Mr. Aswin Techajareonvikul |

26 Apr 2007 |

|

13. Mrs. Thapanee Techajareonvikul |

26 Apr 2018 |

The average tenure of board members is 9.65 years, based on 13 members of the Board of Directors. (as of 15th August 2025)

Significant Changes of Board of Directors

(1) General Thanadol Surarak resigned from Board of Director, effective February 1, 2024. Click

(2) Mr. Prasit Kovilaikool resigned from Board of Director, effective February 21, 2024. Click

(3) Mr. Charoen Sirivadhanabhakdi resigned from Board of Director, effective April 22, 2025 and was appointed as Chairman Emeritus, effective April 22, 2025. Click1 Click2

(4) Mr. Thapana Sirivadhanabhakdi was appointed as Board of Director, effective April 22, 2025. Click

(5) Mr. Sithichai Chaikriangkrai resigned from Board of Director, effective August 1, 2025. Click

(6) Mr. Prapakon Thongtheppairot was appointed as Board of Director, effective August 13, 2025. Click

In addition to Consumer Staples, enabling seamless business operations in response to corporate strategy and stakeholder demands (The number of independent directors is 9, which is counted accordingly to DJSI's criteria).

The below table show name list of Independent Director who meet at least 4 out of 9 DJSI criteria.

|

No. |

Name |

DJSI |

SET |

|

1 |

Prof. Pirom Kamolratanakul, M.D., M.SC. |

ü |

ü |

|

2 |

Mr. Tevin Vongvanich |

ü |

|

|

3 |

Ms. Potjanee Thanavaranit |

ü |

ü |

|

4 |

Mr. Prasert Maekwatana |

ü |

|

|

5 |

Police General Krisna Polananta |

ü |

ü |

|

6 |

Mr. Rungson Sriworasart |

ü |

ü |

|

7 |

Associate Prof. Kamjorn Tatiyakavee, M.D. |

ü |

ü |

|

8 |

Assoc. Prof. Pimpana Srisawadi, DBA. |

ü |

ü |

|

9 |

Mr. Prapakon Thongtheppairot |

ü |

|

To effectively integrate good corporate governance and sustainability consideration throughout the value chain, members of the Board of Directors are selected by the Nomination and Remuneration Committee, in compliance with the Charter of Nomination and Remuneration Committee, selecting members based on individual’s ability to conduct their respective roles and responsibilities, which does not discriminate against an individual board member’s gender, race or ethnicity, or nationality, country of origin or cultural background. BJC also supports women serving on the board of directors, evident from the number of 3 members (23.08% of the Board of Directors), including, Miss Potjanee Thanavaranit, Mrs. Thapanee Techajareonvikul and Associate Prof. Pimpana Srisawadi.

The Board of Directors’ attendance at the meetings during 2024 – 2025 (as of August 15, 2025) was 98.15%.

|

Board of Directors |

Number of attendance (Times) |

|

1. Prof. Pirom Kamolratanakul, M.D., M.Sc. |

9/9 |

|

2. Mr. Thapana Sirivadhanabhakdi |

2/2 |

|

3. Mr. Tevin Vongvanich |

9/9 |

|

4. Ms. Potjanee Thanavaranit |

9/9 |

|

5. Mr. Thirasakdi Nathikanchanalab |

9/9 |

|

6. Mr. Prasert Maekwatana |

9/9 |

|

7. Police General Krisna Polananta |

9/9 |

|

8. Mr. Rungson Sriworasart |

7/9 |

|

9. Associate Prof. Kamjorn Tatiyakavee, M.D. |

9/9 |

|

10. Associate Professor Pimpana Srisawadi, DBA |

9/9 |

|

11. Mr. Prapakon Thongtheppairot |

0/0 |

|

12. Mr. Aswin Techajareonvikul |

9/9 |

|

13. Mrs. Thapanee Techajareonvikul |

9/9 |

As of August 15, 2025

Remark:

(1) General Thanadol Surarak resigned from Board of Director, effective February 1, 2024.

(2) Mr. Prasit Kovilaikool resigned from Board of Director, effective February 21, 2024.

(3) Mr. Charoen Sirivadhanabhakdi resigned from Board of Director, effective April 22, 2025

(4) Mr. Thapana Sirivadhanabhakdi was appointed as Board of Director, effective April 22, 2025.

(5) Mr. Sithichai Chaikriangkrai resigned from Board of Director, effective August 1, 2025.

(6) Mr. Prapakon Thongtheppairot was appointed as Board of Director, effective August 13, 2025.

Directors' Experience and Skills (as of 15th August 2025)

|

No. |

Directors' Experience and Skills |

Experience |

Skills |

||||||||||||

|

Energy |

Materials |

Industrials |

Consumer Discretionary |

Consumer Staples |

Healthcare |

Financials |

Information Technology |

Communication Service |

Utilities |

Real Estate Executive |

Retail Business |

Risk Management |

Internal Audit |

||

|

1 |

Prof. Pirom Kamolratanakul, M.D., M.Sc. |

P |

P |

P |

P |

P |

P |

|

|

|

|

|

|

|

|

|

2 |

Mr. Thapana Sirivadhanabhakdi |

|

|

|

P |

P |

|

P |

|

|

|

P |

|

|

|

|

3 |

Mr. Tevin Vongvanich |

P |

|

|

|

|

|

P |

|

|

|

|

|

P |

|

|

4 |

Ms. Potjanee Thanavaranit |

|

|

|

|

|

|

P |

|

|

P |

P |

|

P |

P |

|

5 |

Mr. Thirasakdi Nathikanchanalab |

|

P |

P |

P |

P |

P |

P |

|

|

|

|

|

P |

|

|

6 |

Mr. Prasert Maekwatana |

|

|

P |

P |

P |

|

P |

|

P |

|

|

P |

P |

|

|

7 |

Police General Krisna Polananta |

P |

|

|

|

|

|

|

|

P |

|

|

|

|

P |

|

8 |

Mr. Rungson Sriworasart |

|

|

|

|

|

|

|

|

|

|

|

|

P |

P |

|

9 |

Associate Prof. Kamjorn Tatiyakavee, M.D. |

|

|

|

|

|

P |

|

P |

|

|

|

|

|

|

|

10 |

Associate Prof. Pimpana Srisawadi, BDA |

|

|

|

|

|

|

P |

|

|

|

|

|

P |

P |

|

11 |

Mr. Prapakon Thongtheppairot |

|

|

|

P |

P |

|

P |

|

|

|

P |

|

P |

|

|

12 |

Mr. Aswin Techajareonvikul |

|

|

ü |

ü |

ü |

ü |

ü |

|

|

|

ü |

|

|

|

|

13 |

Mrs. Thapanee Techajareonvikul |

|

|

|

ü |

ü |

|

ü |

|

|

|

|

ü |

|

|

BJC aims to enhance board performance by aligning corporate governance practices regarding the board of directors' other mandates, which should be restricted to a maximum of five board seats in publicly-listed businesses.

The following table show number of other mandates held by BJC Board of Directors who are Non-Executive Directors and Independent Directors

Non-Executive Directors and Independent Directors Other Mandates Click

|

Names |

Board Type |

Number of Other Mandate |

List of Other Mandates |

|

1. Prof. Pirom Kamolratanakul, M.D., M.Sc |

Independent* |

0 |

|

|

2. Mr. Thapana Sirivadhanabhakdi |

Non-Executive Directors |

4 |

|

|

3. Mr. Tevin Vongvanich |

Independent* |

2 |

|

|

4. Ms. Potjanee Thanavaranit |

Independent* |

4 |

|

|

5. Mr. Thirasakdi Nathikanchanalab |

Non-Executive Directors |

0 |

|

|

6. Mr. Prasert Maekwatana |

Independent* |

0 |

|

|

7. Police General Krisna Polananta |

Independent* |

0 |

|

|

8. Mr. Rungson Sriworasart |

Independent* |

4 |

|

|

9. Associate Prof. Kamjorn Tatiyakavee, M.D. |

Independent* |

0 |

|

|

10. Associate Prof. Pimpana Srisawadi, BDA |

Independent* |

0 |

|

|

11. Mr. Prapakon Thongtheppairot |

Independent* |

0 |

|

* Independent Directors classified according with DJSI criteria. As of 15 August 2025

|

Names |

Board Type |

Number of Other Mandate |

List of Other Mandates |

|

12. Mr. Aswin Techajareonvikul |

Executive Directors |

0 |

|

|

13. Mrs. Thapanee Techajareonvikul |

Executive Directors |

0 |

Management Approach

The BJC Board of Directors includes both independent and executive members from various committees. Among these is the Sustainable Development Committee (SDC), which oversees sustainability management, corporate governance, and business ethics. To assist the board, the Management Board was established, chaired by CEO and President Mrs. Thapanee Techajareonvikul, along with nine senior management executives, top executives and presidents, representing all BJC business units. This board ensures that good corporate governance, transparency, and sustainability are integrated into all of BJC’s activities and decisions.

The Board of Directors fully acknowledges the ongoing changes in internal and external socio-economic factors, which present significant risks and opportunities that BJC must consider, manage and balance in alignment with the principles of good corporate governance. These efforts are aimed at meeting the interests and expectations of relevant stakeholders. The Board continues to oversee the management of these risks and opportunities through day-to-day operations, with the Management Board, led by Chief Executive Officer (CEO) and President, Mrs. Thapanee Techajareonvikul, working alongside top executives and senior management from BJC’s core supply chain operations. This collaborative leadership team is responsible for overseeing overall business operations, formulating policies, and establishing working practices that adhere to the principles of good corporate governance, transparency, business ethics, sustainability, and human rights. All developed policies are designed to ensure that BJC’s operations comply with applicable domestic and international laws, regulations, and standard practices in each operating location and country, safeguarding the company against potential violations. BJC implements a range of proactive measures, including conducting regular risk assessments to identify environmental, social and governance (ESG) risks and establishing mitigation plans for identified issues. The company also ensures ongoing employee training on ethical business practices, sustainability, and human rights issues. Additionally, BJC works closely with local communities, suppliers, and partners to promote responsible practices, strengthen supply chain accountability, and address potential concerns related to labor rights, environmental impact, and corruption. These actions help minimize adverse effects, ensuring that BJC maintains its commitment to sustainability while protecting the long-term interests of stakeholders.

In alignment with BJC’s commitment to good corporate governance and transparency, the members of the Management Board are nominated and selected impartially in accordance with the Charter of the Nomination and Remuneration Committee. Prospective candidates undergo a review and approval process by the Board of Directors, with the stipulation that the Chairman of the Board and the CEO & President must hold independent positions to prevent any one individual from holding both roles and concentrating power within BJC. Following recent changes, Prof. Pirom Kamolratanakul, M.D., M.Sc. has been appointed as the Chairman of the Board of Directors, succeeding Mr. Charoen Sirivadhanabhakdi, who now holds the honorary title of Chairman Emeritus. Mrs. Thapanee Techajareonvikul continues in her role as Chief Executive Officer (CEO) and President. Prof. Pirom Kamolratanakul, M.D., M.Sc., plays a key role in maintaining independent oversight at the highest governance level, especially given the familial relationship between the current Chairman Emeritus and the CEO & President, who are father and daughter, respectively. His responsibilities include ensuring that robust processes are in place to detect and address conflicts of interest, overseeing conflict resolution procedures, conducting appropriate reviews of policies, and ensuring transparent reporting on conflict management to the Board. This governance structure supports the integrity of decision-making and ensures that Board decisions remain impartial and aligned with the best interests of all stakeholders. Furthermore, as stipulated in Article 17 of the Company’s Articles of Association, at least one-third of the directors must resign annually at the Annual General Meeting of Shareholders. The Nomination and Remuneration Committee is responsible for identifying suitable candidates to replace the resigned members, considering qualified individuals—including retiring directors—for pre-approval. The final decision and selection are made during the shareholders' meeting.

According to the criteria set by the Stock Exchange of Thailand (SET), which require that one-third of the directors be independent (at least three individuals), BJC targets to maintain a board where one-third of its members are independent directors, with a minimum of three such directors at all times.

Furthermore, the Management Board is accountable to ensure a seamless business operation, in line with established policies, targets and long-term strategies approved by the Board of Directors. The Management Board is responsible for the overall performance, cost control, and investment budgeting as approved in BJC’s annual plans. The performance of the board of directors is assessed through both self-assessment and independent external party verification, conducted annually in compliance with assessment criteria of the Stock Exchange of Thailand (SET). The self-assessment covers three key criterias, (1) The appropriation of structure of the Board of Directors to operate efficiently, such as ensuring that board members consists of members with relevant industry experiences, have appropriate number of members, and have appropriate number of independent members per applicable requirements. (2) Board of Directors Meeting, such as meeting attendance, and avoid conflict of interest, and (3) Roles and Responsibilities of the Board of Directors, such as Internal management, Risk Management, and Financial management. In 2024, the independent external party verification was conducted by LRQA (Thailand). A similar performance assessment approach is conducted for the Management Board, where the performance is assessed against nine key criteria's, such as, effective management, implementation of corporate strategy and plans, performance of implementation, relationship building and corporate image improvement, and sustainable management.

Board members are elected on an annual basis : In 2025, the Annual General Meeting (AGM) resolved to approve the re-election of Mr. Rungson Sriworasart, Mr. Thirasakdi Nathikanchanalab, Mr. Prasert Maekwatana and Mr. Aswin Techajareonvikul to be the Company’s Directors for another term and approve the election of Mr. Thapana Sirivadhanabhakdi to be the director in replacement of Mr. Charoen Sirivadhanabhakdi who expresses his intention not to be elected as the director for another term.

2024 Self-Assessment of the Board of Directors

In 2024, the Board of Directors carried out a self-assessment using two approaches: a collective evaluation of the Board as a whole and individual assessments of each director. The overall results were highly satisfactory, with scores exceeding 96%. To further strengthen the Board’s effectiveness, it is encouraged that directors regularly participate in training or seminars on good governance practices. This would support continuous learning, help refresh key knowledge, and contribute to the ongoing enhancement of their roles and responsibilities.

To achieve this, the Board of Diretors appointed five sub-committees to work under the Board of Directors to achieve a coherent collaboration with multiple parties to achieve sustaianble business growth. The subcommittees comprise of,

1) Nomination and Remuneration Committee

2) Audit Committee

3) Sustainable Development Committee

4) Risk Management Committee, and

5) The Executive Board

The Board of Directors, as the highest governance body within BJC, maintained its commitment to prioritizing sustainability throughout the reporting year. This reflects an acknowledgment of the numerous positive impact’s sustainability brings to the company, including serving as a key driver of innovation, significantly reducing operational costs and enhancing efficiency and productivity across the value chain and among employees. At the same time, the Board remained vigilant about the negative consequences of inadequate sustainable action, recognizing the risks of legal and regulatory non-compliance, as well as the direct or indirect contribution to long-term environmental and social challenges. These challenges include climate change, resource depletion and human rights concerns, all of which could harm communities and ecosystems. Furthermore, failing to prioritize sustainability could weaken customer trust, damage the company’s reputation and undermine its long-term success. To mitigate these risks, the Board of Directors delegated responsibility for overseeing sustainability-related matters to the Sustainable Development Committee (SDC). This committee is tasked with ensuring that sustainability is integrated into the company’s strategy, policies and operations to prevent or mitigate potential negative impacts. The Committee is responsible for overseeing the company’s sustainability strategy, ensuring alignment with corporate goals, regulatory requirements and industry best practices. This includes reviewing and approving annual sustainability data and disclosures before they are presented to the Board for acknowledgment and publication. To evaluate the performance of the highest governance body in managing the organization’s impacts on the economy, environment and people, the company implements structured assessments, including annual governance performance reviews, key performance indicators (KPIs), third-party audits and stakeholder feedback mechanisms. The Board’s role in integrating sustainability into long-term corporate strategy is also reviewed to ensure continuous improvement and alignment with global standards. Additionally, the Committee holds key oversight responsibilities, including setting sustainability objectives, ensuring compliance with environmental and social regulations, identifying and mitigating risks, monitoring sustainability performance and engaging with stakeholders. The Committee also reviews sustainability disclosures to ensure accuracy before submission for Board acknowledgment and external reporting. Through these processes, the Committee ensures that sustainability remains a core component of the company’s corporate strategy and operational framework. Comprising senior management and independent directors with expertise in sustainability, the committee provides strategic guidance, informed perspectives and effective decision-making to drive the BJC’s long-term environmental, social and governance (ESG) commitments.

The Board of Directors (BOD) delegates responsibility for managing BJC’s economic, environmental and social impacts to senior executives. The CEO & President, supported by the Sustainable Development Committee (SDC) and the Risk Management Committee (RMC), ensures ESG integration into corporate strategy.

Additionally, responsibility for managing impacts is further delegated to employees across various levels to ensure effective implementation:

• The Sustainable Development Sub-Committee (SDS), composed of business unit heads and functional teams, is responsible for implementing ESG policies, conducting impact assessments and aligning sustainability initiatives across operations.

• Business unit’s sustainability working team oversees compliance with sustainability policies.

• Employee Training & Engagement Programs empower all staff to adopt sustainability-focused practices, fostering a culture of responsibility across all levels.

Furthermore, senior executives and other employees report to the Board of Directors (BOD) on the management of the organization’s impacts on the economy, environment and people on a quarterly basis. These reports are provided once every quarter, detailing the organization’s actions, progress and challenges related to sustainability and impact management. The reports cover the economic, environmental and social aspects of the organization’s operations, ensuring that the Board is well-informed to make strategic decisions and take appropriate actions.

Board Diversity

Selecting individuals to serve on the board requires a meticulous process that aligns with BJC’s strategic goals. The selection criteria encompass a wide array of attributes: qualifications, profession, skills, age, experience, gender, ethnicity, religion, origin, expertise, and necessary abilities. Diversity in these attributes ensures a rich mix of perspectives and ideas, fostering innovation and comprehensive decision-making.

The process involves evaluating candidates who not only possess the necessary qualifications but also bring diverse experiences and viewpoints. This diversity contributes to creating value and achieving strategic objectives. Recommendations for board appointments or additions are thoroughly assessed and presented to board meetings and/or shareholder meetings for approval, ensuring that every appointment aligns with the company’s long-term vision.

BJC recognizes the importance of diversity amongst employees of all levels, valuing, and accepting all individual differences such as age, gender, race, ethnicity, and nationality, country of origin or cultural background. This priority is reflected in both the ‘WINNING’ corporate culture, and the ‘CDSH’ corporate values, where diversity is celebrated, encouraged and respected throughout the organization, achieved through the provision of equal opportunities throughout the human resource management process, through to safeguarding good and fair welfares based on performance. This fair treatment and selection of individuals is also reflected in the selection of board members, where board members are selected based on diverse qualifications, including knowledge, capabilities, skills, expertise, and expertise useful for the company, ensuring the capability and diversity of the board of directors to effectively govern the company.

Remuneration Process

The process of determining remuneration & compensation involves the creation and assessment of criteria for directors, Chief Executive Officer and President, Business President, and other roles that are equivalent. These criteria are then presented to the Board of Directors for their approval. After that, the annual compensation and bonuses for these positions are evaluated, and recommendations are made to the Board of Directors and/or shareholders for their approval.

Every year as regular basis, the Board of Directors conducted self-assessments of their performance in accordance with the roles, duties, and responsibilities that they were responsible for. In addition, the company engage LRQA, an independent third party to conduct assessments of the board's performance in 2024 to ensure that the board will perform effectively.

CEO Salary & Benefits: Assessment Criteria

Berli Jucker Chief Executive Officers and President Performance Assessment:

BJC firmly believes that the Chief Executive Officer (CEO) and president holds a critical role in driving business operait BJC firmly believes that the Chief Executive Officer (CEO) and president holds a critical role in driving business operaitons forwards towards achieving the vision “to be a provider of integrated supply chain solution in the region, providing top quality products and services that are involved in the everyday life of people”, creating value for all stakeholders, while achieving long-term and sustainable organizational success.

To uphold a high operational standards, conducted in acordance with good corporate governance, business ethics and anti-corruptions principles, and to ensure that the accountability of the Board of Director's are aligned with that of shareholder's, BJC has established an evaluation process to measure and analyze the performance of the Chief Executive Officers (CEO) and President on an annual basis. This permits company Directors to review and evaluate the performance outputs and achievements of the CEO and President to against identified material issues in conducting their responsibilities during the reporting year. This enables the CEO and President to identify improvement opportunities to increase effectiveness and efficiency to member of the Board of Directors. CEO and President performance are evaluated based on nine key assessment criteria’s which such as, policy and strategy management and strategy implementation, financial performance, sustainability management, and personal attributes, etc., encompassing all requirements to good corporate governance. Furthermore, in alignment with BJC’s commitment to transition towards sustainability, BJC has also integrated sustainability considerations into the CEO and president’s performance assessment such as promoting environmental friendliness, including minimizing global warming, ensuring that sustainability considerations are included in all strategic decisions.

In addition, when assessing financial performance, indicators related to BJC's business performance, such as Return on Equity (ROE) and business growth are taken into account. ROE determines the CEO and president's efficiency in allocating shareholder capital to work and generating value for shareholders, as BJC holds the responsibility to all relevant stakeholders. Business growth rate are evaluated by comparing the annual growth rate to other peers in the retail industry from professional and reliable sources such as a research center or a financial institute, provides a benchmark for retail growth rate for the current period which BJC also uses through its comparisons.

BJC strives to be the market leader in order to obtain a sustainable return by creating a self-reinforcing cost advantage that competitors find difficult to replicate. When developing the company's long-term strategy, BJC takes into account the aforementioned metrics such as ROE, business growth rate, and etc. Additionally, the CEO and president will play a critical role in promoting the company's goal by driving an effective management ahead.

In 2024, the mean and median annual remuneration, including bonuses and fringe benefits, of employees in the core supply chains of the Company and its subsidiaries (i.e. packing supply chain, consumer supply chain, modern retail and its business partner group) range from Baht 261,237-415,355 per person whereby the CEO annual compensation is approximately 60-95 times higher. The mean and median annual remuneration has increased from the previous years in accordance with better business performance of the company in the past year. On forwards achieving the vision “to be a provider of integrated supply chain solution in the region, providing top quality products and services that are involved in the everyday life of people”, creating value for all stakeholders, while achieving long-term and sustainable organizational success.

To uphold a high operational standards, conducted in accordance with good corporate governance, business ethics and anti-corruptions principles, and to ensure that the accountability of the Board of Director's are aligned with that of shareholder's, BJC has established an evaluation process to measure and analyze the performance of the Chief Executive Officers (CEO) and President on an annual basis. This permits company Directors to review and evaluate the performance outputs and achievements of the CEO and President to against identified material issues in conducting their responsibilities during the reporting year. This enables the CEO and President to identify improvement opportunities to increase effectiveness and efficiency to member of the Board of Directors. CEO and President performance are evaluated based on nine key assessment criteria’s which such as, policy and strategy management and strategy implementation, financial performance, sustainability management, and personal attributes, etc., encompassing all requirements to good corporate governance. Furthermore, in alignment with BJC’s commitment to transition towards sustainability, BJC has also integrated sustainability considerations into the CEO and president’s performance assessment such as promoting environmental friendliness, including minimizing global warming, ensuring that sustainability considerations are included in all strategic decisions.

In addition, when assessing financial performance, indicators related to BJC's business performance, such as Return on Equity (ROE) and business growth are taken into account. ROE determines the CEO and president's efficiency in allocating shareholder capital to work and generating value for shareholders, as BJC holds the responsibility to all relevant stakeholders. Business growth rate are evaluated by comparing the annual growth rate to other peers in the retail industry from professional and reliable sources such as a research center or a financial institute, provides a benchmark for retail growth rate for the current period which BJC also uses through its comparisons.

BJC strives to be the market leader in order to obtain a sustainable return by creating a self-reinforcing cost advantage that competitors find difficult to replicate. When developing the company's long-term strategy, BJC takes into account the aforementioned metrics such as ROE, business growth rate, and etc. Additionally, the CEO and president will play a critical role in promoting the company's goal by driving an effective management ahead.

Leadership Succession Planning

A robust succession plan is critical for key leadership roles such as Chairman, CEO, and Managing Director. BJC's governance framework includes evaluating and proposing qualified candidates for these positions. Potential successors are identified based on their experience, leadership qualities, and alignment with BJC’s strategic goals. Succession planning is not merely about filling positions but ensuring continuity and stability in leadership. It involves regular assessments and readiness plans to ensure that BJC is never caught off-guard by sudden leadership changes. The board continuously evaluates potential candidates and presents their recommendations for approval in board meetings, ensuring that leadership transitions are smooth and strategically aligned.

Long-term Incentive

As an incentive and compensation for CEO, executive officers and employees of the company and/or relevant subsidiaries to motivate all employees to work to their fullest potential for the benefit of the company and shareholders, BJC offers and issues the warrants to purchase the ordinary shares of the Company (“Warrant”) under the BJC Employee Stock Option Scheme 2018 (BJC ESOP 2018 Scheme), which is still offered throughout 2024. The incentive also aims to retain executives who exhibited outstanding performance to continue working for the company in the long run to achieve the set business goals. Details of the ESOP 2018 Scheme is available in the Form One Report 56-1 2024, PDF Page 450-451. In regards to CEO and other executive officers, they are also eligible to the ESOP, where by 2032, BJC requires CEO and top executives to hold stock ownership in the company of not less than 6 and 15 times respectively of their annual base salary. Furthermore, BJC also have a 5 year performance period applied to evaluate variable compensation (based on predefined targets, either relative or absolute), covered in executive compensation plan, while the CEO holds a 5 year time vesting period for variable compensations, incentivising them to drive operational growth accordingly. Finally, 0 percent of the CEO's short-term incentive are deferred in the form of shares or stock options.

Moreover, BJC established the clawback policy as a guideline for directors, executives, and employees to perform their respective duties with responsibilities, prudence and honesty, in compliance with applicable laws, company regulations, and the resolutions of the board of directors and stakeholders. The clawback policy was established in conformance to the Public Limited Companies Act B.E. 2535 (1992), Section 85, and the Securities and Exchange Act B.E. 2551 (2008), Section 89/7, 89/18, 89/19 and 281/2.

The policy states that BJC holds the right to reclaim return which executives have received or reduce future returns in the event a director or executive is found to perform misconduct, caused damage to BJC, or cause benefits to themselves or to those involved.

In the event that an executive is fired, terminated or discharged with fault, BJC can reclaim any returns or benefits that have not been exercised. The clawback of an executive is subject to review and approval by the Management Board, unless the executive is a member of the Management Board, the Executive Board will be in charge of the review and approval.

| Shareholding | Number of Share in 2024 |

| CEO and President | None |

| Executives* | 27,000 |

*Mr. Vichien Rungwattanakit holds 27,000 shares, the multiple of base salary is 1.57

Climate Related Management Incentives

In addition, to support BJC’s continued transition towards sustainability and to foster the corporatewide 1+5 Strategy, and Net Zero by 2050 target, BJC has integrated Climate-Related incentives as part of the KPI’s, which starts from the highest management level and are cascaded down to each relevant subsidiaries, departments, working teams, and individuals. Details are as follow,

| Management Level | Type of Incentive | Incentivized KPIs | Details | |||

|

Chief Executive Officer (CEO) |

|

Monetary |

|

Emissions reduction |

|

BJC has implemented a performance-based monetary incentive system that links a portion of the Chief Executive Officer’s (CEO) compensation to the achievement of sustainability-related targets. This incentive mechanism strengthens accountability at the highest management level and supports BJC’s company-wide ambition to achieve Net Zero greenhouse gas (GHG) emissions by 2050. As part of this framework, BJC has established a Key Performance Indicator (KPI) for the CEO to oversee and drive the company’s sustainability efforts. This KPI includes responsibilities for leading climate change mitigation initiatives, particularly through the reduction of both direct and indirect GHG emissions, in alignment with the company’s sustainability management and succession planning criteria. |

|

Executives Officers |

|

Monetary |

|

Emissions reduction |

|

BJC has established Key Performance Indicators (KPIs) for members of the management board and presidents of business units. These KPIs are customized to align with the specific nature of each business under their responsibility. For example, senior executives overseeing the packaging business are assigned KPIs focused on reducing energy consumption from both fuel and electricity within production processes, as energy use is a major contributor to greenhouse gas (GHG) emissions. These efforts contribute to the overall reduction of BJC's Scope 1 and Scope 2 GHG emissions through process improvements and increased energy efficiency. |

|

Manager |

|

Monetary |

|

Energy reduction |

|

BJC has established Key Performance Indicators (KPIs) for business unit managers to take responsibility for performance related to the reduction of energy consumption. This initiative aims to mitigate the impact of rising electricity costs and the overall greenhouse gas (GHG) emissions associated with electricity use, thereby reducing operational expenses and lowering Scope 2 GHG emissions from production activities. Moreover, the company is increasing its use of renewable energy sources, such as solar and hydropower, to further reduce its carbon footprint and enhance long-term energy resilience. This transition not only supports BJC’s sustainability goals but also reduces dependency on fossil fuel-based electricity, contributing to the achievement of its Net Zero target by 2050. |

Code of Conduct

BJC established code of business conduct for executives, directors and all employees to understand the ethical standards that the company uses in its business operations as the company believes that the ethical guidelines are an important tool in enhancing the transparency of the company's operations. This will lead to confidence in investors or all relevant parties, including the better performance of executives, directors and employees. Key issue in the code of business conduct as follows:

| - Conflicts of Interest | - Anti-Competitive Practice and Antitrust |

| - Anti-Corruption and Bribery | - Whistleblowing |

| - Human Rights, Equality and Discrimination | - Information Security& Cybersecurity |

| - Trading Security and Insider Trading | - Internal Control and Audit, and Accounting and Financial Report |

| - Responsibility to Stakeholders | - Employee Treatment |

| - Social Responsibility | - Safety, Occupational Health and Environment |

Additionally, the code of conduct also extends to joint ventures. In 2022, the code of conduct covers 100% of joint ventures, 100% of joint ventures has provided written/digital acknowledgement of the code of conduct, and 100% of joint ventures has been provided with training of the code of conduct.

Anti-corruption and Bribery Management

As part of BJC’s commitment to conduct business under Good Corporate Governance practices, BJC developed a corporate-wide Anti-Corruption and Bribery Policy, evidencing BJC’s commitment to controlling and managing risks against all illegal activities such as corruption within the organization. Procedures are in place to address corruption operations that are assessed to be “high risk,” covering elements/types of corruption, including bribery and anti-corruption measures comprehensively. These procedures include clear guidelines, regular training, monitoring mechanisms and reporting channels to effectively mitigate corruption risks throughout the organization. The approach ensures that corruption is prevented, detected and addressed in all its forms, in compliance with both local and international anti-corruption standards. The policy was developed in accordance with applicable policies and the Thai Anti-corruption laws which is overseen by the group Human Resource Department and all Business Units, requiring that all senior management, directors and employees, strictly adhere to the policy, which clearly states that employees shall not engage with any form of fraud or bribery and follow protocols instructed regarding the actions of giving or accepting gifts and entertainment.

Furthermore, the policy is governed by the legal and HR department, whom routinely consolidates data for further development. To ensure accurate compliance to the policy and business ethics, BJC provide all essential information and training to all employees, assessing employees understanding, with emphasis on new employees to ensure that they understand the significance of the policy as outlined.

Moreover, BJC continues to communicate with business partners and relevant stakeholders to encourage and foster awareness regarding this issue, contributing to BJC’s intention to create a culture of integrity, absent from any forms of frauds and corruption, fostering a successful and sustainable growth of this business.

In addition, BJC places strong emphasis on enhancing employee awareness and understanding of the company’s policies and practices. The Anti-Corruption and Bribery Policy and related guidelines are incorporated as a mandatory component of the onboarding training program for all new employees. Upon completion of the training, employees are required to complete a post-training assessment to ensure a thorough understanding and ability to effectively apply the policy in practice.

To maintain continued awareness, BJC reinforces anti-corruption practices throughout the year by regularly communicating key messages to all employees via internal communication channels, including email and the corporate intranet. These communications cover important topics such as the “No Gift Policy” and other relevant guidelines.

Whistleblower Programs

This commitment is reinforced through the implementation of a company-wide whistleblower program, providing a transparent communication channel for all employees. The program is actively communicated to employees to encourage a culture of reporting, enabling them to report any suspected activities, illegal actions, fraudulent behavior, violations of the law, codes of conduct, rules and regulations, as well as instances of discrimination, harassment, or other unethical practices. The program includes an independent 24/7 reporting hotline, available in local languages, including Thai and English. All whistleblowers are protected under the whistleblower protection measures outlined in the Anti-Corruption and Bribery Policy, which ensures that reports can be made anonymously and are treated with confidentiality. These safeguards protect the identity and safety of whistleblowers, further promoting the use of the reporting channel.

All whistleblower reports will undergo an initial review and verification by the Group Audit Department, which is responsible for overseeing the whistleblowing mechanism. Once verified, cases will be escalated to the Investigation Committee and/or Inspection Taskforce, comprising representatives from the Group Human Resources Department, Group Audit Department, Legal Department, and the Head of the relevant Business Unit where the incident occurred.

Investigations will be conducted in accordance with the Whistleblowing Policy and the BJC Code of Conduct. Upon completion, findings will be reported to the Risk Committee for review and appropriate action, and outcomes will also be communicated to the Board of Directors for their information.

To ensure the privacy and confidentiality of whistleblowers and all reported information, BJC fully complies with the Organic Act on Anti-Corruption 2018*. The company has adopted this legislation to establish robust internal procedures, as outlined in the Anti-Corruption and Bribery Policy (Clause 4 – Anti-Corruption and Bribery Measures), which guarantee comprehensive and lawful protection for whistleblowers.

For operations in Malaysia, BJC has appointed Syntrio, an independent third party, to manage the whistleblowing channel. This allows individuals to submit anonymous reports through a secure, confidential reporting system.

Access to reported information is strictly limited to authorized personnel only, including relevant business unit heads and the centralized Independent Audit Committee. All incident reports are submitted to management for review and action. In cases involving senior management or classified as high-risk, the reports are escalated directly to the centralized Independent Audit Committee for handling in accordance with established procedures.

Appropriate disciplinary actions and training are implemented accordingly to prevent any reoccurrence of violations within BJC. In 2024, BJC is continuing an investigation training workshop for all business unit executives, to improve working process and audit guidelines to prevent frauds, emphasizing on wholesale business-to-business (B2B). The Lost and Prevention (LP) department is responsible for conducting the workshop, providing knowledge sharing of various cases, communicated to each branch’s monthly, and conducts training twice a month. For cases that violate applicable laws, BJC will take necessary legal actions accordingly to discipline the individual, including termination of employment.

The Whistleblowing Channel is likewise included as a required element of the onboarding training for new employees. BJC ensures that all employees are fully informed of the available reporting channels, applicable procedures, and their rights to whistleblower protection. These efforts are intended to ensure that employees feel confident and secure when reporting concerns.

Breach Case

Breaches and violations of the Corporate-wide Code of Conduct are considered major compromises to BJC business practices. As a result, all breaches are addressed promptly and in accordance with applicable laws, regulations, and standards, which may result in corrective action plans in the form of disciplinary actions such as legal action and termination of employment to discipline individuals and resolve cases within the reporting year. The Human Resource Department closely monitors employee compliance with the Code of Conduct, and the Loss and Prevention Department oversees retail compliance. All employees are encouraged to actively report Code of Conduct breaches and suspicious breaches through established channels, such as whistleblower, to the investigation team, which includes representatives from Human Resources, Group Audit Department, Legal, and the relevant Head of Business Unit where the incident occurred.

Total Number of Substantiated Breach against the Code of Conduct 2024

| Reporting Areas | Number of Breaches in 2024 |

| Substantiated corruption and/or bribery cases | 138 |

| Cases involving discrimination and/or harassments | 0 |

| Cases involving customer privacy data | 0 |

| Cases involving conflicts of interests | 0 |

| Cases involving money laundering and/or insider trading | 0 |

| Coverage | 100% |

Total Number of Information Security/Cybersecurity Breaches

| Reporting Areas | Number of Breaches in 2024 |

| Total number of information security breaches | 0 |

| Total number of clients, customers and employees affected by the breaches | 0 |

There were no fines or convictions imposed on the company in relation to corruption and bribery during the latest fiscal year.

Action to manage Risk related to Cybersecurity

Preventive Actions

To fortify the protection of sensitive and critical company data, several proactive measures will be implemented. These include enhancing the existing data loss prevention system, deploying anti-malware and ransomware systems to mitigate unauthorized access, and enforcing strict access controls. Measures such as disabling USB access at specified locations, implementing time-based user and password restrictions, and promptly suspending access after designated periods will be enforced. Additionally, a comprehensive data classification process will be established to manage and control access to sensitive data effectively. Regular educational initiatives will also be conducted to enhance user awareness and foster a culture of vigilance against data theft and fraud.

Detective Actions

To bolster our threat detection capabilities, proactive tools such as CrowdStrike and Cyber Command will be utilized. These systems will continuously monitor and preemptively identify potential malware, viruses, and other security threats. Furthermore, an additional N-SOC team will be established to oversee and respond to any detected instances of malware or cyber attacks swiftly. These measures aim to enhance our ability to detect and mitigate cybersecurity risks in real-time, ensuring robust protection of organizational assets.

Corrective Actions

In response to recent updates and standards, corrective measures are underway to streamline operational protocols. This includes updating the call tree process for the new CMST to align with current best practices. Additionally, a coordinated effort is in progress to review and revise Business Continuity Management Plans (BCPs) across all departments. These actions are designed to enhance organizational resilience and ensure that response strategies are optimized to mitigate operational disruptions effectively.

Substantiated breach against the code of conduct identified in 2024 are categorized into three key types, consisting of theft (60.1%), embezzlement (34.1%) and frauds (5.8%), for a total of 138 cases. The 138 cases identified in 2024 represents an increase of 10 cases (8.6%) from the 128 cases identified in FY2023. The increase in identified and substantiated breaches of the code of conduct can be attributed to the implementation of enhanced detection measures, the adoption of stricter enforcement protocols and the improved identification of fraudulent behaviors throughout 2024 such as,

• Reinforcement of suspicious behavior identification and punishment training, for all branch managers, conducted through the Learning & Capabilities Development team.

• Additional information input criteria in the internal knowledge system, to increase the timely identification and review of employee activities to identify fraudulent activities and minimize loss. Additional information input criteria include, void, cancel, delete, return, member card and money deposits.

• Additional internal fraud audit checklist for store visits, used by relevant departments such as Loss and Prevention (LP), operations and HR. Results are also shared to other departments for awareness.

• Established knowledge sharing sessions of significant corruption cases to encourage awareness for all relevant departments in the weekly Store General Manager meetings and the monthly LP Head meeting.

• Established campaign activities to foster whistleblowing and provide awareness posters to be posted in designated areas in all branches and headquarter.

• Develop fraud detection processes using technology by implementing an alert system to notify relevant stakeholders of suspicious activities. Additionally, establish a Continuous Monitoring program to ensure ongoing surveillance and assessment.

In 2024, all identified corruption cases were individually investigated by the Loss and Prevention Department (LP). The findings were reported to the relevant departments for acknowledgment and feedback, which were subsequently incorporated into the development of proactive and reactive measures to prevent future occurrences.

Furthermore, throughout 2024, BJC continued to implement various procedures to educate and train employees on adhering to the Code of Conduct. These efforts have proven successful, as of 31st December 2024, BJC had no pending or completed legal actions during the reporting period related to anti-competitive behavior, anti-trust violations, or breaches of monopoly legislation involving the organization. Since 2018, the Fraud Case Management System (FCS) served as a centralized database for consolidating fraud-related data, facilitating investigations and offender background evaluations. Each case was recorded individually and categorized as either “Prosecuted” or “No legal action required”. Currently, BJC utilizes the Suspicious Person Management System (SPMS), which replaces FCS to enhance security and risk management. SPMS provides a more comprehensive approach by integrating advanced analytics, real-time monitoring and risk assessment tools to identify and manage individuals who may pose security threats. The system continues to support fraud prevention efforts while expanding its capabilities to address broader security concerns.

BJC continues to prioritize the establishment of an anti-corruption culture throughout its value chain, extending this commitment to relevant stakeholders, including suppliers, with a particular focus on critical and significant suppliers. This commitment is reinforced by incorporating anti-corruption clauses into supplier agreements and providing annual supplier training, both online and in-person, to ensure a clear understanding and compliance. BJC has successfully assessed and trained 100% of its critical suppliers, ensuring their adherence to an agreement with the anti-corruption policy. In 2024, the assessment found no violations of the Supplier Code of Conduct. Additionally, BJC remains committed to encouraging all suppliers to develop and comply with their own anti-corruption policies, further reinforcing a corruption-free operational environment.

Starting from 2022, BJC mainly prioritizes cases involving fraudulent activities, such as theft, fraud, and embezzlement. Based on these variables, the number of corruption and bribery cases that violate the BJC's code of conduct in 2024 can be categorized as follows.

- Cases caused internally by BJC employees under BJC's control, including all BJC Big C employees, housekeepers, and security officers, for which BJC has operational responsibility.

- Cases involving employees who have passed the probationary employment period established by BJC Big C Group.

- Cases are classified as significant when they result in at least 5,000 baht in financial harm, with an assumption that anything less than 5,000 baht can be readily controlled using current corruption and bribery control procedures, and thus no longer considered serious

Communication of Incidents and Critical Concerns

The Loss and Prevention Department (LP) actively identifies incidents through a centralized reporting system. These incidents are consolidated and communicated monthly to the Store’s Safety Committee, which posts them on bulletin boards to raise awareness. They are also reported to the BJC-Big C HO OSH&E Committees. The monthly reports include statistics on incident occurrences, as well as information on other emergencies such as fires, floods and crisis drills, including active shooter scenarios for stores.

The Crisis Management Support Team (CMST) compiles monthly reports on accident and f ire statistics, along with case studies and disseminates them to Big C stores via email. This enables the stores to share relevant information through channels such as safety information boards and the CMST Line group. Furthermore, CMST presents these reports during Occupational Health and Safety Committee meetings held at BJC’s head office. For incidents with significant impact, a concise one-page summary is prepared and reported to executives and management.