test

2 End hunger, achieve food security and improved nutrition and promote sustainable agriculture

goal 3

goal 4

goal 5

goal 6

goal 7

goal 8

goal 9

goal 10

goal 11

goal 12

goal 13

goal 14

goal 15

Goal 16

16.3: Promote the rules of law and the national and international levels and ensure equal access to justice for all.

16.5: Substantially reduce corruption and bribery in all their forms

16.7 Ensure responsive, inclusive, participatory and representative decision-making at all levels

16.b: Promote and enforce non-discriminatory laws and policies for sustainable development

Goal 17

Risk Management & Compliance

Risk Management and Compliance Strategy

In 2022, the world slowly began to emerge from the grips of the COVID-19 pandemic, and business activity had resumed but it had not yet reached pre-pandemic levels. The situation had been further complicated by the Russian-Ukrainian War, China's lockdowns, rising inflation, increasing energy prices, and exchange rate fluctuations, all of which had the potential to affect business operations directly and indirectly. Furthermore, natural disasters resulting from the effects of global warming posed an additional threat to the sustainability of business operations. Moreover, as awareness of climate change grew, consumers were increasingly demanding sustainable products and services. This had led to the rise of eco-friendly products and services, requiring businesses to adapt their product and service offerings and marketing strategies.

BJC realized that it was crucial that the company carefully consider these external factors and their potential impacts when crafting sustainable business strategies. The company recognized the urgent need for corporate risk and crisis management in today's ever-changing and unpredictable global landscape by going above and beyond to mitigate the risks and challenges associated with these issues. BJC's proactive approach to risk management in 2022 involved identifying potential risks and implementing measures to address them before they become crises. For instance, the company had taken significant steps to reduce its carbon footprint and promote sustainable practices across its diverse portfolio of businesses. By investing in various initiatives, BJC was not only mitigating the risks associated with climate change, but also going beyond that by demonstrating its commitment to environmental sustainability and social responsibility.

Risk Management and Compliance Management Approach

BJC has prioritized risk and crisis management as an integral part of its business strategy. By conducting risk assessments and developing comprehensive crisis response plans, BJC is prepared to respond quickly and effectively to unexpected events, such as natural disasters or political instability. Through its commitment to risk and crisis management, BJC is demonstrating its dedication to ensuring the long-term success and sustainability of its business, while also contributing to a more resilient and sustainable economy. At BJC, corporate risk management is held in high regard. To ensure effective Corporate Risk Governance, the Risk Management Committee authorized by the Board of Directors, oversees the risk management process, while senior management keeps a watchful eye on the risk management of each business unit. Moreover, to further ensure the effectiveness of enterprise risk management of the organization and aligned with the international standards such as ISO 31000, the company conducts an internal audit of the risk management process by Group Internal Audit Department's experienced personnel with a full understanding of BJC's nature of business and supporting functions. As well as an external audit that was conducted in 2022, with no non-compliance issue. The Risk Management Committee also formulates and reviews corporate-wide risk management policy, goals and frameworks to be appropriate for the company's business operations in accordance with the national and international standards. Furthermore, BJC's corporate risk management strategy goes beyond simply assessing risks. In fact, the company also actively seeks out new business opportunities that arise from potential risks. This approach not only ensures the preservation of company value but also creates additional value for both BJC and its stakeholders.

Risk Governance

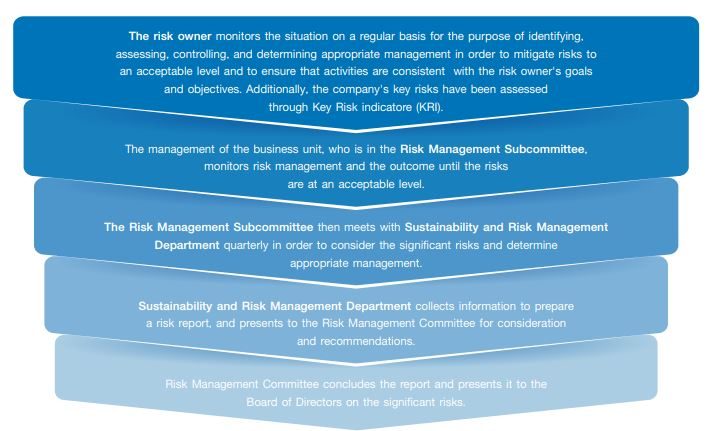

The Risk Management Committee (RMC) is structural independence from the business units to supervise enterprise risk management, including define the methods and processes used by organizations to manage risks and seize opportunities related to the achievement of company objectives. Risk Management Subcommittee (RMS) reviews, creates, identifies and assesses BJC’s corporate and business unit level risks. The subcommittee will assess, consolidate and report cooperate and ESG risk assessment to the Risk Management Committee and BJC’s Board of Directors on a quarterly and annual basis respectively. Audit committee is responsible for evaluate the efficiency of BJC’s risk management to ensure the relevance and effectiveness.

Moreover, BJC's non-executive members of the board of directors consist of experts with diversed experiences and backgrounds. There are 2 non-executive members of the board of directors with expertise in risk management: 1) Mr. Tevin Vongvanich, who has experiences in risk management from Amata Corporation Public Company Limiteda and Indorama Ventures Public Company Limited 2) Ms. Potjanee Thanavaranit , who had a training on Risk Management Program for Corporate Leaders from Thai Institute Of Directors (IOD).

Additionally, Sustainability and Risk Management Division (SRMD) support risk communication to build a risk culture by educating employees at all levels on the importance of risk management, including the development of a common language, creating the understanding and supporting management decisions. SRMD promotes the effectiveness of project-level and enterprise-wide risk management with the focus on raising risk awareness for the management and staff to have proper and appropriate utilization of resources and involvement in actions.

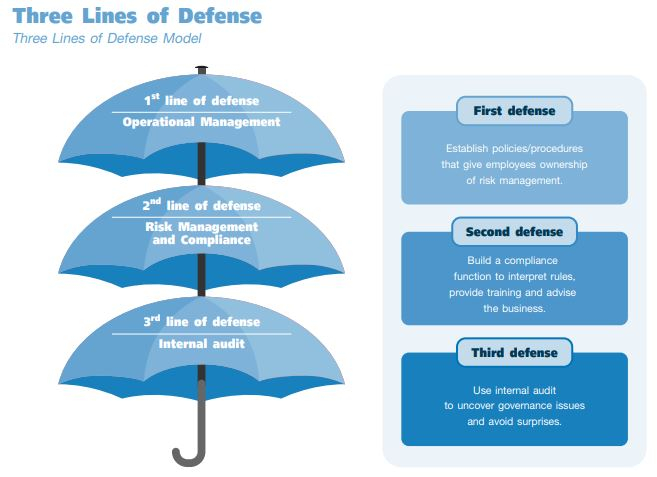

BJC strictly complies with the principles of supervision and risk management outlined in The Three Lines Model (2020) of Institute Auditors: IIA, cascaded into the 'Three Lines of Defense’ process to oversee risk management, separating structures, roles, duties, responsibilities, and decision-making authority, ensuring process transparency through BJC’s Board of Directors, Risk Management Committee (RMC), Risk Management Subcommittee (RMS), Audit Committee and Sustainability and Risk Management Division (SRMD).

Highest ranking person with dedicated risk management responsibility on an operational level: Ms. Anchalee Rimviriyasab, Chief Financial Officer.

Reporting line: Sustainability and Risk Management Division (SRMD) reports to Risk Management Committee (RMC) concerning overall risk management in the organization. This includes risk analysis of impacts to the company if such risks were to occur, in order to ensure the effectiveness of BJC’s risk management plan. Risk Management Committee’s meeting is held quarterly (4 times per annum). The Chairman of RMC reports to the Board of Directors on the company's overall risk management performance on a quarterly basis. Meanwhile, SRMD also reports to the CEO and President to ensure that the risk management execution plan is aligned with business strategy, on schedule, as well as effective in managing risk within risk appetite.

Highest ranking person with responsibility for monitoring and auditing risk management performance on an operational level: Mr. Phadya Sootrsuk, Head of Group Internal Audit Division.

Reporting line: Group Internal Audit Division (GAD) directly reports to Audit Committee (AC) to consult and assess whether operational and compliance control policies and strategies in status quo cover existing and emerging risks to the company. The reporting line enables independent assessment without potential conflict of interests coming from other departments. Audit Committee’s meeting is held at least quarterly (4 times per annum) with the addition meetings between internal auditors to expression of independent opinions without Management’s influence. The chairman of AC reports to the Board of Directors on the company's overall control and relevant issues on a quarterly basis. Meanwhile, GAD also reports the implementation of projects or activities contributing to risk management, monitoring and auditing to CEO and President, to ensure effective internal control cover financial, operational and compliance control.

Risk Assessment and Management Process

BJC has a continuous risk management with the following Risk Assessment and Management Process;

BJC has established policies and risk management process in order to assess, consolidate and report cooperate and ESG risk assessment on quarterly basis and annual basis respectively. In 2022, processes across BJC’s business group have 100% of risk assessment in all business unit, and 100% of all business unit have mitigation plan. The assessment has been implemented throughout BJC to constantly monitor risk management processes. Throughout the procedure, the key cooperate risk (KRI) is developed to serve as a predicator for precaution and monitoring of risk management efficiency.

Furthermore, BJC uses RM online system to collect data and prepare risk reports of business units to achieve more efficient risk management. As for the risk assessment, the risks are categorized as follows;

The RM online system enables the business units to access risk management real-time, anytime and anywhere. The system also saves time for BUs by providing risk evaluation tools, which are relevant to the objectives of each BU. This allows the Risk Impact to be more accurately calculated and the risk impact can better reflect the current situation of different business operations. Finally, the root causes of the risks are determined as well as the impact of the risks, which includes financial impact and non-financial impact. The Risk Level is then determined by assessing the impact and likelihood of the risks. The company assess the risk level before inherent risk, and then identify the existing management and management that needs to be done so that the level of residual risk is acceptable. For the risk management that needs to be done, responsible persons are assigned and the due date is also set.

Risk Management 2022

BJC realizes the need of continuous learning and adaptation in order to navigate economic changes and unforeseen situations. Additionally, they emphasized the value of contributing to and being responsible for the environment and society. As a consequence, BJC has established a business operation strategy, including proactive and passive measures, to ensure that the business runs effectively and efficiently. BJC assesses potential positive (Opportunity) and negative (Risk) factors impacting business operations for the benefit of all stakeholders and the long-term sustainability of the company.

As for Emerging Risk, BJC monitors news and information then the company considers related risks continuously to formulate prompt and appropriate mitigation actions. After the analysis, the significant emerging risks at present which may affect BJC's business are updated and described below.

Emerging Risk

1. Risk from Rising Costs of Living for Customers

In 2022, as the world continues to recover from the COVID-19 pandemic, consumer demands have returned to pre-pandemic levels. At the same time, various factors such as the Russian-Ukraine war continue to drive price increase of numerous product groups, such as energy, fertilizers, and food to increase, raising the cost of living for consumers. The effects of the COVID-19 pandemic continue to endure in some countries, especially China, further affecting the supply chain of certain industries. This disruption is further intensified since natural disasters such as floods and droughts continue to become more frequent and severe because of global warming, affecting the security, quality, and quantity of agricultural products, rise in product prices as operating expenses such as electricity bills increases, affecting operating expenses and ultimately consumer expenditures. The reasons mentioned have caused rising product prices and consumer cost of living, restricting consumers purchasing power, and thus affects consumer decision making.

Business Impact

As a result, future shortages of goods may increase, leading to higher living costs for consumers, including expenses for food, transportation, housing, and other necessities. This could create significant financial pressure on consumers. When consumer purchasing power declines, it also impacts the sales and profits of companies. Consumers will prioritize their purchases and reduce spending on non-essential items, leading to decreased sales in these product categories. Regarding essential goods, consumers are more likely to focus on purchasing reasonably priced products that offer better value for money. This trend could potentially reduce the initial profit margins of companies. At the same time, competition in the retail industry will intensify as businesses vie for customers with limited budgets, trying to attract them with the most cost-effective products available.

As the group’s business operations, including retail business, consumer goods business, and packaging business are highly dependent on consumer purchasing power, such business activities are impacted from consumer’s lowered purchasing power, impacting their respective decisions to buy products and services from the company group, for both products sold in Big C stores and BJC Group own brand products, as consumers are more likely to be more consciousness of their purchasing decisions, reducing likelihood of certain products groups to be sold, especially products deemed as nonessentials, expensive and extravagant, to instead pay more attention to the value of products. Moreover, as the competition within the industry continue to intensify, especially for price competition to attract and retain customers within the market, the mentioned pressuring factors may affect the company’s revenue, decreasing the overall income and/or affecting the company’s ability to achieve planned targets.

Mitigation Actions

The company group prioritizes private label products, which are high quality products, sold at reasonable prices. The sales of such product groups are promoted through various channels and forms to encourage consumer spending, utilizing various information available to analyze and develop appropriate management plans, including offering customized products and services offering to better meet customer needs, emphasizing on customers with high purchasing power and international tourists. Moreover, the company group aim to increase productivity and work efficiency to lower operating expenses to control product costs, and maintain profits levels as planned, without increasing product prices.

2. Risk from New Laws Related to Climate Change

Following the 26th Conference of the Parties (COP26) by the United Nations Framework Convention on Climate Change (UNFCCC), the world including Thailand has become more aware of the importance to solve the issue of global warming and climate change. As such, various government agencies and relevant entities have considered establishing laws and regulations related to climate change, such as the Climate Change Act. (Global Warming Act) and Carbon Tax, which will be enforced within the next 1-2 years. In addition to the Extended Producer Responsibility (EPR) law, which is relevant to packaging and is being enforced, along with environmental regulations, in which are prioritized by government agencies, including reducing the use of plastics, emphasizing on single-use plastics and waste separation, since the mentioned rules and regulations are expected to be enforced more stringently in the near future.

Business Impact

Should laws and regulations related to the mitigation of climate change be introduced in the near future, BJC’s business operations will be impacted from the law’s enforcement to change and improve the current working process to meet the requirements of the new regulations, such as waste separations regulations. As a result, the company must adapt and improve certain work processes to meet the waste separation legal requirements, which may also incur various legal expenses, for instance, the carbon tax will increase the company’s tax expenditure. In order to effectively manage these new regulatory changes, the company requires the use of all available resources such as manpower, time, and investments. If the company fails to comply with these changes fully and accurately it may face prosecution or incur fines and penalties as stipulated within the law.

Mitigation Action

BJC actively monitored the progress and changes of law and regulations related to climate change, and have continuously establish and foster good relationships with government agencies and other related organizations such as the Greenhouse Gas Management Organization (TGO), and the Federation of Thai Industries etc. Additionally, BJC became an active member of the Carbon Neutral Network of Thailand, which provides BJC with the opportunity to receive news and information of regulatory changes related to climate change in a timely manner, ahead of non-members. Moreover, the membership offers BJC with the opportunity to present its respective opinions and suggestions on the preparation of new laws and regulations to be more suitable for the business sectors. Furthermore, BJC is preparing for various laws and regulations which may be enforced in the near future, achieved through a centralized data collection template to collect, and consolidate greenhouse gas emissions data, which are audited by external auditors, ensuring that the information disclosed publicly are in compliance with international standards. BJC have also established goals and plans to reduce greenhouse gas emissions, such as installing solar rooftops to increase the proportion of clean energy utilization, Project to reduce electricity consumption and project to transition logistics vehicles to be electric vehicles (EV).

These plans can help to mitigate the impacts of carbon taxes and/or other regulations. Beyond this, BJC have a comprehensive and transparent complaint handling process in place to build and foster good relationships with various stakeholders to reduce the risk of complaints and prosecutions, and to alleviate the damage caused.

3. Risk from Biodiversity Loss

In 2022, natural ecosystems and biodiversity were under threat due to the risks facing the planet's ecosystems such as drought, floods, wildfires, deforestation, soil degradation, sea degradation, and marine degradation. Moreover, climate change and the emergence of new diseases and invasive species created a complex web of risks, which increased the likelihood of species extinction and global ecosystem collapse. Given the dependence of Big C's fresh food products on natural ecosystems and biodiversity, the risk of biodiversity loss had become a significant concern, as it could affect the quality and quantity of agricultural products. This could lead to potential shortages of goods in the long run and result in higher prices for the affected raw materials, which, in turn, would increase production costs. Moreover, it could impact not only BJC businesses but also BJC's own supply chain.

Business Impact

A loss of biodiversity can have a ripple effect on various aspects of the ecosystem. Specifically, it can delay the ability of certain plants or animals to reproduce or grow in their natural habitat. As a result, it directly impacts the agricultural, livestock, and fisheries sectors, which are the primary sources of raw materials and goods for the company. This loss of biodiversity can also lead to shortages in the supply chain, which can cause an increase in production costs for the company. The company may be forced to raise the prices of products to maintain profitability. Unfortunately, this increase in prices can also affect consumers' purchasing decisions. When products become more expensive, consumers may choose to buy less or opt for more essential goods, which ultimately leads to a decrease in revenue for the company. The potential consequences of biodiversity loss could pose challenges for businesses, especially those dependent on agricultural goods, as it may influence the overall quality and amount of produce. This, in turn, might lead to shortages of goods in the future and consequently drive up prices for the impacted raw materials, thereby raising production costs. Additionally, there is a chance that the raw materials or products might not meet consumer expectations in terms of quality.

For the BJC Group, over 40% of their total revenue comes from food products, and they purchase agricultural produce to use as raw materials for their factories and retail in stores at nearly 50,000 tons per year. Consequently, the effects of biodiversity loss and environmental degradation will be evident from the production process, where the company will face increased costs. Subsequently, selling products might become more difficult due to issues related to quality and pricing not aligning with customer preferences. This will impact the revenue of the company. If these issues persist and cannot be mitigated or resolved, it could eventually lead to a significant scarcity of essential raw materials or products, resulting in the company facing a complete loss of revenue in that specific sector.

Mitigation Plan

BJC has implemented comprehensive Environment Policy and Biodiversity Policy aimed at conserving environment and biodiversity and guiding its operations. In 2022, to ensure that biodiversity risks were minimized, the company conducted thorough assessments of each operational area and established management practices accordingly. To achieve this, the company's factories conducted biodiversity surveys to assess the impact of their business activities on the environment, and provided training to employees in various departments involved in creating ecological impacts, with the aim of raising awareness and education. In addition, BJC actively encouraged its suppliers to recognize the importance of biodiversity conservation, and worked with the suppliers to ensure that their activities were aligned with the company's goals. There were also other actions taken in 2022 as follows;

- BJC placed significant emphasis on forest conservation, and took steps to prevent deforestation such as planting trees both land forest and mangrove forest, and having pulp certified by the Forest Stewardship Council (FSC) for tissue paper production.

- BJC was also committed to responsible waste management practices to minimize its impact on the environment planning several projects in the pipeline such as circular farm.

- BJC closely monitored changes in consumer behavior and government regulations in order to respond appropriately and promptly if significant changes occur.

Raising Risk Awareness and Education

In order to promote and enhance an effective risk culture throughout BJC, The Sustainability and Risk Management Division (SRMD), implemented Enterprise Risk Management (ERM) training, conducted annually in alignment with COSO Requirements.

The Enterprise Risk Management Framework (ERM) provide training on how to assess, mitigate and monitor relevant risks to each business unit and track process for both new and existing business units (upon request). Risk management workshop has also been conducted with responsible persons in each business unit/factory at the organizational level to increase knowledge of risk management and the awareness of all employees, aiming to instill a strong recognition of appropriate risk management procedures to all. BJC has also developed the Standard Operating Procedure (SOP) for Enterprise Risk Management in Risk Management Online System (Company Intranet) to facilitate risk assessment processes and increase the efficiency of data collection of the improved system.

In 2022:

- SRMD team provided the training to all factories under BJC.

- PwC (Thailand) provided the training to Big C high-level executives.

- The content included; ERM in BJC business context, risk management and its relations to ESG and trends to watch out for in ERM.

The Sustainability and Risk Management Division (SRMD) annually provides a Top Risk Summary to the Risk Management Committee (RMC) and Audit Committee (AC). The Top Risk Summary includes global risks, significant risks, and emerging risks that BJC businesses currently face, as well as a Risk Prevention and Mitigation Plan and latest-risk management best practices. All of the information was compiled and summarized from articles, research, and other trustworthy sources. Thus, the report will be elevated to the head of each BU/BP for consideration whether their business mitigation plans and control activities are adequate, appropriate, and efficient in terms of managing risks to an acceptable risk level and are consistent with standard risk management practices. All of this is to enable RMC and AC to verify that BJC's risk management is effective, efficient, and appropriate.

Crisis Management

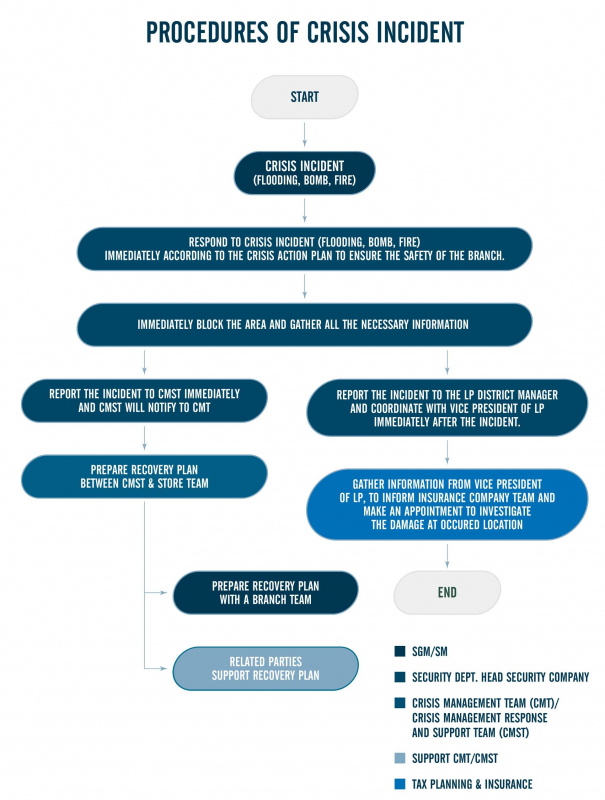

BJC is fully equipped to handle unforeseen events and incidents with great efficiency. The company has taken extensive measures to ensure that it is well-prepared for any crisis that may arise. One such measure is the establishment of a Crisis Management Response and Support Team. In addition, the company has consistently invested in the development of its crisis management and business continuity plans.

Crisis Management Structure

Crisis Management 2022

|

1. Insurgency in the South of Thailand (3 southern border provinces) |

|

|

Recovery & Preventive Actions: • Set up a war room to coordinate the affected Big C branches and provided assistance. The war room also monitored the situation closely and report to the crisis management team. • Coordinated with local security agencies and created a group line to monitor the situation within the areas. • Communicated crisis plan in case of finding suspicious objects to Big C branches in the south of Thailand as well as rehearsing the action plan. • Assigned other Big C branches to be a “store partner” to support affected branches in case of emergency. • Initiated more flexible operating hours for Big C branches in the areas. • Installing more CCTV points at Big C branches in the areas.

|

|

|

2. Flood and Windstorm |

|

|

Recovery & Preventive Actions: • Coordinated with Big C employees at nearby branches to support affected branches for inventory handling, flood prevention and product transfer. • Followed updates from government agencies (Meteorological Department, National Water Administration, Hydrographic Department) and alerted Big C branches for surveillance. • Provided a guideline and protocol for flood and storm prevention and monitored areas with high risk. • Rechecked the stability of Big C branches’ buildings located at areas with high risk.

|

|

|

3. COVID-19 |

|

|

Recovery & Preventive Actions: • COVID-19 prevention measures had been reduced to align with Thailand’s public health • Adjusted protocols for infected people: quarantine for 5 days, and high-risk contacts could work normally • Encouraged employees to receive 3 or more doses of COVID-19 vaccine • Remained the focus on DMHT: Distancing, Mask wearing, Hand washing and Testing • Monitored the situation of infected people weekly and monitored the situation updates from the Department of Disease Control, the Ministry of Public Health

|

|

|

4. Other Crisis Preventive Actions |

|

|

• Conducted bare-handed combat skills training and mass-shooting contingency plan for BJC head office. • Conducted advance firefighting training for Big C branch fireman officers.

|

|

Artificial Intelligence (AI) Thermoscans at Big C

Big C has planned to implement a smart thermometer temperature using Artificial Intelligence (AI) technology to screen, and detect masks and face recognition for employees, customers and visitors to Big C branch and Headquarter. The thermoscans accommodates for large number of customers, ensuring safety while safeguarding building credibility with government investigation through the following process

Big C has planned to implement a smart thermometer temperature using Artificial Intelligence (AI) technology to screen, and detect masks and face recognition for employees, customers and visitors to Big C branch and Headquarter. The thermoscans accommodates for large number of customers, ensuring safety while safeguarding building credibility with government investigation through the following process;

|

|

|

- Temperature screening: measure customer and visitor body temperature, alerting individuals with higher than normal body temperature, indicated by Green (normal), Red (abnormal)

- Mask Detection: monitor customer and visitor mask, detect by yellow (no mask), Green (Mask)

- Face Recognition: detect individuals on non-blacklist and blacklist from recorded list in systems, alerting relevant parties via phone application and location. Temperature detection is expected to be 90% accurate, compared to real face proportions. BJC expects to expand use of this technology in other Big C branches.